About the one factor individuals keep in mind about Jay Gould, the most important robber of the Robber Barons, is Black Friday, the day in September 1869 when he blew up the inventory market – and nearly each different market, from metals to grains — in a failed bid to nook gold. It is due to Black Friday that the Joseph Pulitzer known as him “sinister,” the New York Occasions known as him Mephistopheles and Mark Twain known as him “the mightiest catastrophe to ever befall this nation.”

Black Friday may have been the tip of Gould, a ruthless and crafty stock-price manipulator who could not look individuals within the eye. Had he not bribed judges to flee collectors and prosecutors, he might need ended up penniless. However he survived and considerably cleaned up his act. He went on to create a large fortune by, like Warren Buffett and Berkshire Hathaway BRK.A,

BRK.B,

shopping for nice companies and holding on for years.

With the earnings he made on telegraph big Western Union, the Union Pacific transcontinental railroad and different main corporations, Gould gathered sufficient wealth to rank excessive in up to date lists of all-time richest Individuals.

Most nice fortunes are made by constructing big firms. Consider Invoice Gates and Microsoft MSFT,

Jeff Bezos and Amazon, Sam Walton and Walmart WMT,

and, in earlier age, Henry Ford and Ford Motor Co. F,

Gould is the one fats cat aside from Buffett who did it by being an amazing investor.

What can we study from Gould, who was value greater than $80 billion when he died 130 years in the past (when calculated as a share of GDP, the accepted solution to measure wealth throughout time)? What secrets and techniques does he provide about getting cash on Wall Road?

Nicely, we will not bribe judges. We will not get somebody like Boss Tweed, the New York Metropolis energy dealer and one in every of Gould’s associates, to go legal guidelines at our bidding. Nor can we have interaction in insider buying and selling, self-dealing, and pump-and-dump buying and selling schemes. Regardless of being thought of morally reprehensible, these tips had been completely authorized in Gould’s day and routinely practiced.

However we are able to put a few of his strategies to worthwhile — and authorized — use.

-

Get the info. Gould devoted newspapers, credit score studies and tip sheets. He traded gossip all day and, after having dinner at dwelling along with his household, went to resort bars to commerce extra data at night time. A up to date Gould can be throughout Twitter TWTR,

-2.23% ,

reddit, MarketWatch and different web sites, in search of nuggets of knowledge and gauging the temper of the market. - Be affected person. Gould stated the one inventory not plentiful on Wall Road is the inventory of endurance. He failed in his first try to purchase Western Union. However he saved his eye on it and ultimately received the prize at an agreeable value.

- Know the numbers. Gould did not make investments on hunches. If he purchased a railroad, he knew the worth it paid staff, what it paid for coal and the way a lot its opponents charged prospects. A lot of what passes for evaluation in the present day is nothing greater than regurgitation of firm statements. Such skinny analysis will not get an investor far.

- Learn every little thing, not simply stuff about investing. Good learn the classics. He learn Dickens. He learn historical past. His broad information gave him perspective that helped him keep calm below fireplace.

- Go in opposition to the grain. Gould made his first fortune by shopping for railroad bonds that nobody else wished at 10 cents on the greenback.

- Keep liquid. The panic of 1873 began one of many longest recessions in US historical past. Good misplaced a fortune. However he was by no means illiquid. As inventory costs grew to become ridiculously low-cost, he plowed in. Though the panic worn out among the greatest names on Wall Road, it was among the many greatest issues to ever occur to Gould.

- Work onerous, however remember your well being. When Gould was a boy rising up on a farm, he rose earlier than daybreak to check Latin and algebra by candlelight. By the point he was 15, he was working a number of jobs. He slept so little that he caught typhoid fever, and it nearly killed him. Gould suffered respiratory points the remainder of his life and died at age 56, earlier than he had time to whitewash his fame by, like fellow robber baron Cornelius Vanderbilt, endowing a college or, like Andrew Carnegie, one other robber baron, constructing a live performance corridor and a nationwide community of libraries.

-

Watch out for brief squeezes. The difficulty with shorting shares is that potential losses are infinite. Gould would typically go brief however extra typically took the opposite aspect, shopping for shares that had been closely shorted, gobbling up all the provision and charging high greenback when the sellers needed to return borrowed shares. In fact, those that shorted Gamestop GME,

-5.45%

or AMC Leisure AMC,

-5.51%

know this lesson already. - Know the regulation and authorized procedures. Even when he did not have a choose in his pocket, he fared effectively in court docket. Why? As a result of he knew what was allowed and knew that his adversaries would accept pennies on the greenback simply to be completed with him.

Simon & Schuster

However crucial lesson we are able to study from Gould is one which his victims realized the onerous means: Traders ought to watch what individuals do, not what they are saying.

Gould appreciated that individuals had been gullible. A company chieftain is perhaps spewing lies, however his listeners take it to the financial institution due to a bent to consider what’s stated by individuals in energy. Good exploited that weak spot. He lied on a regular basis, promising rosy earnings when he was promoting and forecasting collapse when he was shopping for. Those that believed him suffered the results.

Ought to we consider no matter Elon Musk says about Tesla TSLA,

? Would Gould?

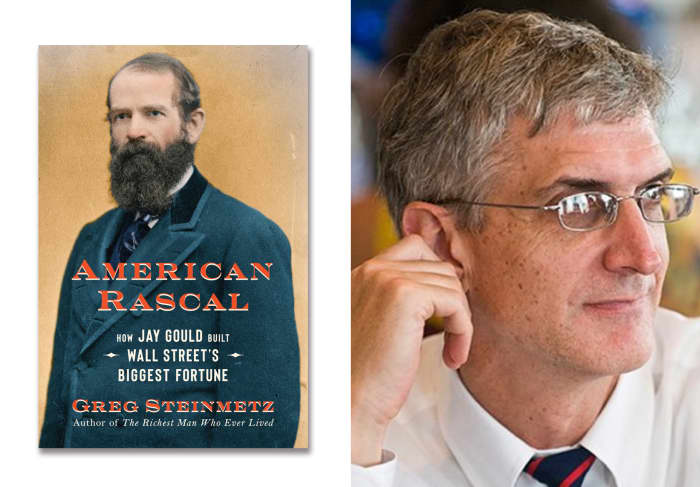

Greg Steinmetz is the writer of “American Rascal: How Jay Gould Constructed Wall Road’s Largest Fortune”. He’s a associate at a cash administration agency in New York.

Extra from MarketWatch

To be a greater investor, learn extra good novels

7 money-making classes from the richest man who ever lived

‘Time within the inventory market is extra vital than timing the market’ and extra crucial cash and investing classes I want my youthful self had understood

These 3 powerful questions on an organization’s CEO may also help traders spot alternatives that others miss

Here is the easiest way to identify stock-market winners, in line with this 25-year tech analyst