martince2

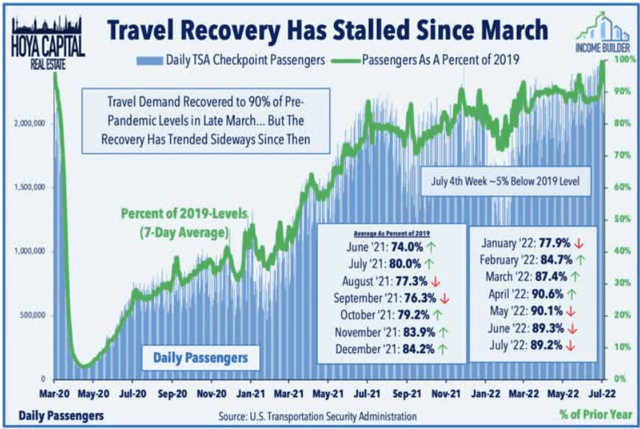

COVID hit Resort REITs further onerous, however this yr has seen quite a lot of leisure journey throughout the US Knowledge from the Transportation Security Administration exhibits that journey passengers, as a proportion of 2019 ranges, reached primarily 100% in July of this yr, after diving to close zero in April 2020.

Hoya Capital Earnings Builder

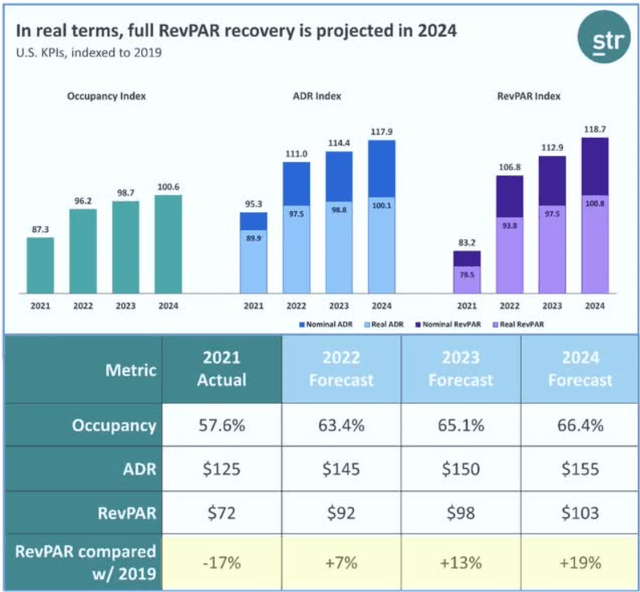

Based on Hoya Capital’s analysis, resort occupancy is again to 96% of the 2019 fee, whereas ADR (common every day room fee) is up 11% and RevPAR (income per out there room) is up 7%. Nevertheless, when inflation is taken under consideration, ADR is down about 2.5% and RevPAR is down about 6.2% since 2019. All three metrics (Occupancy, ADR, and RevPAR) are anticipated to be totally recovered to pre-pandemic ranges in actual phrases by 2024.

Hoya Capital Earnings Builder

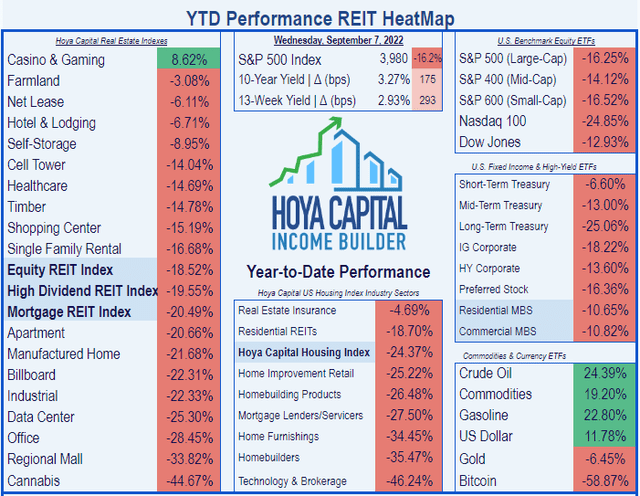

Because of this, Resort REITs are the fourth-best performing REIT sector of 2022, with a mean complete return of (-6.71)%, in comparison with the Fairness REIT Index mark of (-18.52)%.

Hoya Capital Earnings Builder

The forecast for earnings progress is excellent, all throughout the Resort REIT sector.

So the query is, in case you are involved in beginning or rising a place in a resort REIT, which firm? This text zeroes in on the one Resort REIT greatest positioned to reward buyers over the subsequent 12 months.

First Criterion: Stability Sheet

There are 15 US Resort REITs. Since a strong stability sheet is the required basis of any robust funding, let us take a look at how these 15 corporations are positioned for liquidity and debt, so as by market cap.

| REIT Motels | Liquidity | Debt Ratio | Debt/EBITDA | Bond |

| Hosted Motels & Resorts (HST) | 2.29 | 32% | 3.4 | BB+ |

| Ryman Hospitality (RHP) | 1.00 | 38% | 6.9 | B |

| Apple Hospitality (APLE) | 3.07 | 30% | 4.0 | — |

| Park Motels (PK) | 1.81 | 57% | 10.6 | B |

| Pebblebrook Resort (PEB) | 1.95 | 43% | 15.0 | — |

| Sunstone Resort Buyers (SHO) | 3.14 | 19% | 2.5 | — |

| RLJ Lodging (RLJ) | 1.95 | 56% | 7.5 | B+ |

| DiamondRock Hospitality (DRH) | 2.00 | 36% | 8.0 | — |

| Xenia Motels (XHR) | 1.90 | 49% | 7.0 | B |

| Service Properties Belief (SVC) | 1.21 | 93% | 14.9 | B+ |

| Summit Resort (INN) | 1.45 | 44% | 8.0 | — |

| Chatham Lodging (CLDT) | 2.41 | 46% | 9.0 | — |

| Hersha Hospitality (HT) | 1.44 | 62% | 9.0 | — |

| Braemar Motels (BHR) | 1.43 | 89% | 11.5 | — |

| Ashford Hospitality (AHT) | 0.98 | 102% | 15.5 | — |

| Sotherly Motels (SOHO) | 1.13 | 73% | 18.7 | — |

| InnSuites Hospitality (IHT) | 1.60 | 29% | — | — |

| REIT common resort | 1.81 | 41% | 9.5 | — |

| General REIT common | 1.90 | 25% | 6.4 | — |

Supply: Hoya Capital Earnings Builder and TD Ameritrade

Within the desk above, values shaded in inexperienced are higher than each the Resort REIT common and the general REIT common. Values shaded in yellow lie between the Resort REIT common and the general REIT common. Values shaded in crimson are beneath each averages.

As you may see from the underside two rows, the Resort REIT sector is in worse form than the REIT sector total, with liquidity decrease and debt considerably greater.

There are a variety of distressed stability sheets on this sector. Since we’re on the lookout for the perfect Resort REIT to spend money on, we are able to safely get rid of each firm whose Liquidity Ratio, Debt Ratio, or Debt/EBITDA is worse than the Resort REIT common. That features each firm with any crimson in its row of values. This eliminates all however 4 candidates: HST, APLE, SHO, and DRH.

This isn’t to say that not one of the different Resort REITs might make you some cash as an investor. For instance, Sotherly Motels (SOHO) was just lately designated by Zacks as a Sturdy Purchase. It is simply that with stability sheets that weak, they’re too huge a danger for my style.

Second Criterion: Funds From Operations

Wholesome corporations do a great job of steadily rising revenues, that are greatest measured within the REIT world by FFO (Funds From Operations) per share. Let’s examine how our 4 candidates are doing in that regard.

| ticker | 3-year FFO Progress | 5-year FFO Progress | * 2022 FFO Progress | * 2023 FFO Progress |

| HST | ( -2.1)% | ( -0.3)% | 174% | 7.2% |

| APPLE | ( -3.2)% | ( -3.1)% | 58% | 13.6% |

| SHO | (-11.3)% | ( -8.0)% | 1750% | 33.8% |

| DRH | ( -6.1)% | ( -2.5)% | 633% | 17.0% |

| REIT common resort | (-6.4)% | (-15.0)% | 888% | 29.9% |

Supply: Hoya Capital Earnings Builder

*Projected

The trailing 3-year and 5-year FFO progress numbers present that every one 4 of our candidates are outperforming the Resort REIT common, which nonetheless hasn’t recovered to its pre-pandemic ranges. However all 4 considerably lag the general REIT averages of 9.1% and seven.8%, respectively. The exception is SHO, which is outperforming Motels on 5-year progress, however underperforming on 3-year progress. Thus, Sunstone has been a bit slower to get well from COVID than the opposite three candidates.

The projected progress figures for 2022 are gaudy. That’s principally as a result of most Resort REITs simply returned to optimistic FFO final yr, so the comparables are extraordinarily simple. Thus, the projected 2022 Resort REIT common FFO of $1.58 per share appears nice, in comparison with 2021’s common of simply $0.16. (Wow! that is an 887.5% enhance! See what I imply?)

SHO appears nice on this yr’s projected FFO progress column, exactly as a result of it was the slowest of the 4 candidates to return to optimistic FFO. By the identical token, APLE’s projected progress of 58% appears anemic alongside the others’ triple-digit charges, however that’s as a result of APLE emerged sooner and stronger than the others, so its comparables are more difficult.

Probably the most significant and eye-opening determine on this desk is the Resort REIT sector’s projected common FFO progress per share for 2023: a whopping 29.9%. Of our 4 candidates, solely SHO outpaces the pack on that metric. The others lag the projected common, exactly as a result of they’ve emerged sooner and stronger than the others.

All 4 of our candidates are projected to develop at wholesome charges.

Dividend metrics

That is the place we begin to see some separation. Itemizing our 4 candidates once more so as by market cap, a transparent favourite emerges.

| Firm | Div. Yield | 3-yr Div. Progress | Div. Rating | Payout | Div. Security |

| HST | 2.72% | (-18.9)% | 1.45 | 30% | A |

| APPLE | 5.29% | (-11.2)% | 3.70 | 50% | A+ |

| SHO | 0.00% | (-33.0)% | 0.00 | 10% | — |

| DRH | 0.00% | (-33.0)% | 0.00 | 10% | — |

| REIT accommodations avg | 1.71% | (-26.3)% | 0.68 | 17% | A |

| REITs total | 3.38% | 6.2% | 4.05 | 59% | C |

Supply: Hoya Capital Earnings Builder, TD Ameritrade, Searching for Alpha Premium

Dividend Rating initiatives the Yield three years from now, on shares purchased right now, assuming the Dividend Progress fee stays unchanged.

As you may see, APLE far outshines the opposite candidates in present Yield, and actually, APLE is paying nicely above the REIT common, at 5.29%. Each firm within the Resort sector eradicated its dividend throughout the COVID sell-off. APLE was the primary to revive its dividend. So when dividend progress fee is taken under consideration within the Dividend Rating, APLE emerges just a bit beneath the REIT common, at 3.70, however far forward of second-place HST at 1.45.

Valuation metrics

Let’s record our candidates so as by dividend rating now, and take a look at valuation.

| Firm | Div. Rating | Value/FFO ’22 | Premium to NAV |

| APPLE | 3.70 | 10.4 | (-16.5)% |

| HST | 1.45 | 9.9 | (-23.3)% |

| SHO | 0.00 | 13.9 | (-14.6)% |

| DRH | 0.00 | 9.1 | (-190)% |

| REIT common resort | 0.68 | 10.2 | (-22.4)% |

| General REIT common | 4.05 | 19.5 | (-5.0)% |

Supply: Hoya Capital Earnings Builder, TD Ameritrade, and writer calculations

The common Resort REIT these days is “cut price” priced at 10.2 instances FFO for 2022, barely over half the Value/FFO ’22 of the typical REIT. Our 4 candidates are clustered close to the Resort REIT common, with SHO on the excessive facet at 13.9x, and DRH on the low finish at 9.1. The distinction is sufficient to drop SHO to fourth place, however would not warrant any change within the first and second selections. Solely Host Motels (HST) trades at a reduction higher than the Resort REIT common, and simply barely.

Market cap “Candy Spot”

Analysis by Hoya Capital signifies that the dimensions of a REIT exerts an actual affect on its complete return. The optimum measurement is “higher mid-cap,” from $4 – $10 billion. That is the Candy Spot. Subsequent greatest is massive cap, then “decrease mid-cap,” from $1.4 – $4 billion. Small cap REITs deliver up the rear.

Right here is how our 4 candidates stack up on this key issue.

| Firm | Market Cap |

| Hosted Motels & Resorts (HST) | $12.6 B |

| Apple Hospitality (APLE) | $3.6 B |

| Sunstone Resort Buyers (SHO) | $2.4 B |

| DiamondRock Hospitality (DRH) | $1.9 B |

Supply: TD Ameritrade

Of the 4, APLE is the closest to the Candy Spot, at $3.6 billion. The following most favorable spot is held by HST, at $12.6 billion.

Dialogue

That is sort of a no brainer. As a result of practically all Resort REITs pay very low dividends, investing in any of them besides APLE is a price play. Buyers are usually not fairly as yield-crazy as they have been earlier within the yr, and the true value of cash has come down some. So the setting for progress investing is best than it was in January, however it nonetheless is extra of a price investor’s setting. From a progress standpoint, it’s troublesome to determine a frontrunner within the pack. Nevertheless, from a price standpoint, there is no such thing as a contest, as a result of one firm boasts a vastly superior dividend.

And the winner is . . .

The Resort REIT that emerged first and strongest from the pandemic, with a robust runway of FFO progress, the primary to revive its dividend, and the one one which pays an above-REIT-average Yield:

Apple Hospitality REIT